Portfolio Analysis

Good organisations know that successful project, program and portfolio management is all about planning. Portfolio Analysis is the ultimate planning process, in many cases it takes place before the financial new year, to identify, and prioritise initiatives for the next FY based on strategic objectives for that year. But what if these plans change mid-year? Then you might need to do another portfolio analysis, and another, and another.

pmo365 can simplify the portfolio analysis process giving you full control of your portfolio, in order to prepare you for any unforeseen challenges, allowing you to run more detailed analyses and implement the necessary changes.

How does pmo365 helps with Portfolio Analysis

We can improve the effectiveness of portfolio analysis by:

Complete control over all activities

Giving stakeholders complete control over all activities across every level of the organisation so there are no critical information gaps when they are making decisions on a strategic level.

Streamlining the portfolio prioritisation

Streamlining the portfolio prioritisation process by providing calculations on the quantified value and impact of programs and projects on a strategic level.

Visibility and Accessibility

Providing key stakeholders and decision makers with the necessary visibility and accessibility to information to ensure resources are being optimised based on their strategic value.

What is Portfolio Analysis?

A portfolio is a collection of initiatives/projects that are linked together and defined by strategy and cost. A portfolio will contain three different types of initiatives, those within the planning phase, business cases that haven’t been approved yet, and projects which are already running. Portfolio analysis is about weighing the total budget against the total estimated cost of the projects within the portfolio. It is about prioritising and optimising these projects to ensure the most optimal strategic value is being met.

The Project Management Institute defines benefits as 'an outcome of actions or behaviors that provide utility, value, or a positive change to the intended recipient.' In the PPM setting, benefits are differentiated from project results or capabilities as they go beyond broad and overarching goals and objectives. They are inherently tied to the business’s strategic objectives to make sure that projects outputs are not simply attractive numbers, but properly justified through the business strategy.The key characteristic of a benefit is that they are definable, measurable and as a result, realisable.

What is the Portfolio Analysis Process?

At its core, portfolio analysis is all about prioritising and optimising your projects in terms of strategic value to ensure the most important projects are being complete, within your budget constraints. Let’s say your company has a budget of $10 million dollars, but the estimated cost of running and completing every project in the portfolio is $20 million dollars. What do we do? Well, we run a portfolio analysis!

Calculate the initial incurred cost of running projects

Before you begin the process of prioritising and optimising, you must first identify the initial cost already incurred by the projects which are already running. Many organisations won’t include running costs into their portfolio calculations as it can be a very complicated calculation. From our above example, we can say that this incurred cost is $5 million, leaving us with only $5 million dollars remaining to cover the total portfolio cost of $15 million dollars.

How to prioritise and optimise your Portfolio?

As mentioned earlier, the portfolio analysis process involves two key elements, prioritising and optimising. The process of prioritising and optimising must be complete in order to successfully align with the company’s strategic objectives.

To understand the difference between prioritising and optimising your portfolio, it is vital that you have a grasp on the definition of each concept. Prioritising is the process of ordering items in order of importance, whereas optimising is about selecting items on the basis of making it as effective as possible in achieving strategic objectives - these items could be, but may not necessarily be in the prioritised order. To create a prioritised list of projects, you must calculate the value of each initiative. You may calculate this in terms of Net Present Value (NPV), Return on Investment (ROI) or another factor which represents value to your business. However, the most popular way to calculate project value is through strategic value, and this technique is what we will focus on.

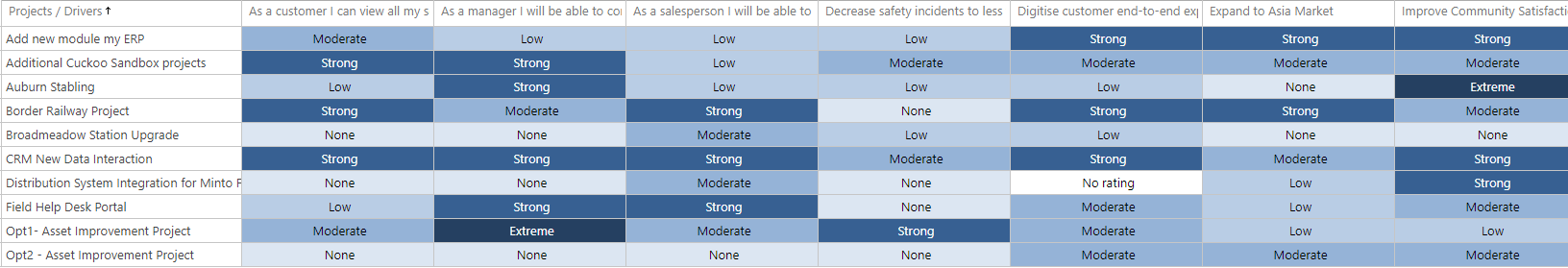

How Strategic Value is used to Prioritise and Optimise your Portfolio

Strategic value is the value created from weighing up a certain strategic direction in terms of an organisation’s strategic pillars, and then by identifying the strategic impact a singular project will have on each pillar. A company’s strategic direction for a financial year may also be defined as the overall aims of a business in a year and the strategic pillars can be defined as the company's core objectives which make up the company vision. Let’s say a company has four strategic pillars (A, B, C & D), and based on their company direction, they decide to put 50% of their focus onto A, 20% onto B, 25% onto C and 5% onto D. Now, we must scale each of our business cases/projects in terms of how much impact it has on each pillar. Using a scale from 1 (low impact) to 5 (high impact) we could find that the business case’s level of impact has been calculated as:

- A = 3

- B = 1

- C = 5

- D = 5

Next, you must multiply this number by the strategic direction percentages from earlier, giving a value for each:

- A = 3 x 50% = 1.5

- B = 1 x 20% = 0.2

- C = 5 x 25% = 1.25

- D = 5 x 5% = 0.25

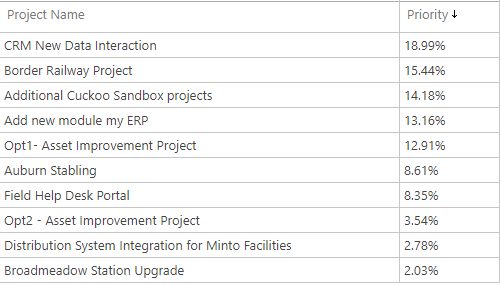

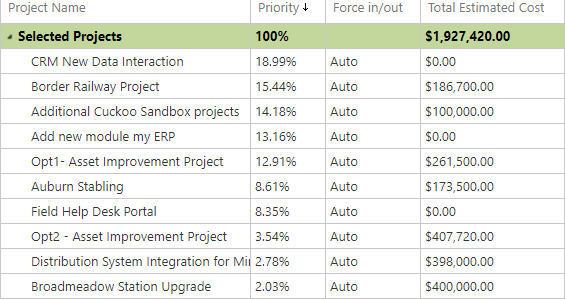

The sum of these values forms the strategic value of your business case, which is 3.2. This process is done several times with several different business cases, garnering different strategic values. We then weigh these up against the cost of each business case. This will allow for an easy prioritisation - where you pick the business cases in terms of highest value to lowest value until your budget runs out. This is the most basic way of selecting projects.

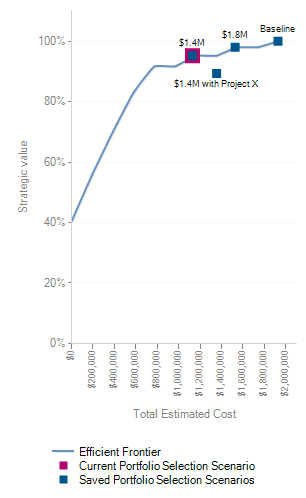

The other way is through optimisation, which will give you the maximum strategic value within a portfolio. In other words, if you had a budget of $5 million and the strategic values of 4 different projects were 3.9, 2.5, 2 and 1.8 and they costed $2.5 million, $2 million, $1.5 million and $0.5 million respectively then prioritisation would choose the first two (with strategic value 3.9 and 2.5 = 6.4). However, if we implemented an optimisation tactic then we would choose the projects with strategic value 3.9, 2, and 1.8. Both of these options would fall within the budget, however the optimisation technique would obtain a greater strategic value of 7.7. There is a mathematical calculation called ‘efficient frontier’ which makes this process of optimisation much easier.

How to Calculate Optimal Strategic Value in Portfolio Analysis?

There are a few ways to calculate optimal strategic value, however the main two are ‘efficient frontier’ and ‘Monte Carlo simulation’.

Efficient Frontier

Efficient frontier is the most popular method of calculating optimal strategic value. It calculates optimal strategic value by putting the information onto a chart, with the target value on the y-axis and the constraint (or the risk) on the x-axis. You can put a maximum budget value into this calculation and it will give you the best possible strategic value for your business. Alternatively, you can put in your maximum portfolio strategic value and get the budget to complete this.

Monte Carlo Simulation

Monte Carlo simulation is a much more complex way to calculate strategic value and is used for large projects. This process involves creating a simulation to uncover ways to increase or decrease certain areas (such as time and risk) of a portfolio in order to optimise strategic value. Even with this detailed outline of the portfolio analysis process, it may still seem like a daunting task to complete. This is where pmo365 comes in, we can synthesise this process so you don’t have to.

Our partners

We've worked with

Project Management Process: The Complete Guide from Start to Finish

Scrum Meetings: The Backbone of Agile Team Communication

Lag Time in Project Management: What It Is and Why It Matters